A Union flag flutters from a pole atop the Bank of England, in the City of London on August 7, 2025.

Niklas Halle’n | Afp | Getty Images

LONDON — The Bank of England on Thursday voted narrowly to hold interest rates steady, exercising caution ahead of the government’s Autumn Budget in November.

Out of the BOE’s nine-member monetary policy committee, five members voted to hold the key interest rate, known as Bank Rate, at 4%, while four opted for a 25 basis point cut.

The vote was slimmer than expected with economists polled by Reuters expecting a 6-3 split in favor of a hold.

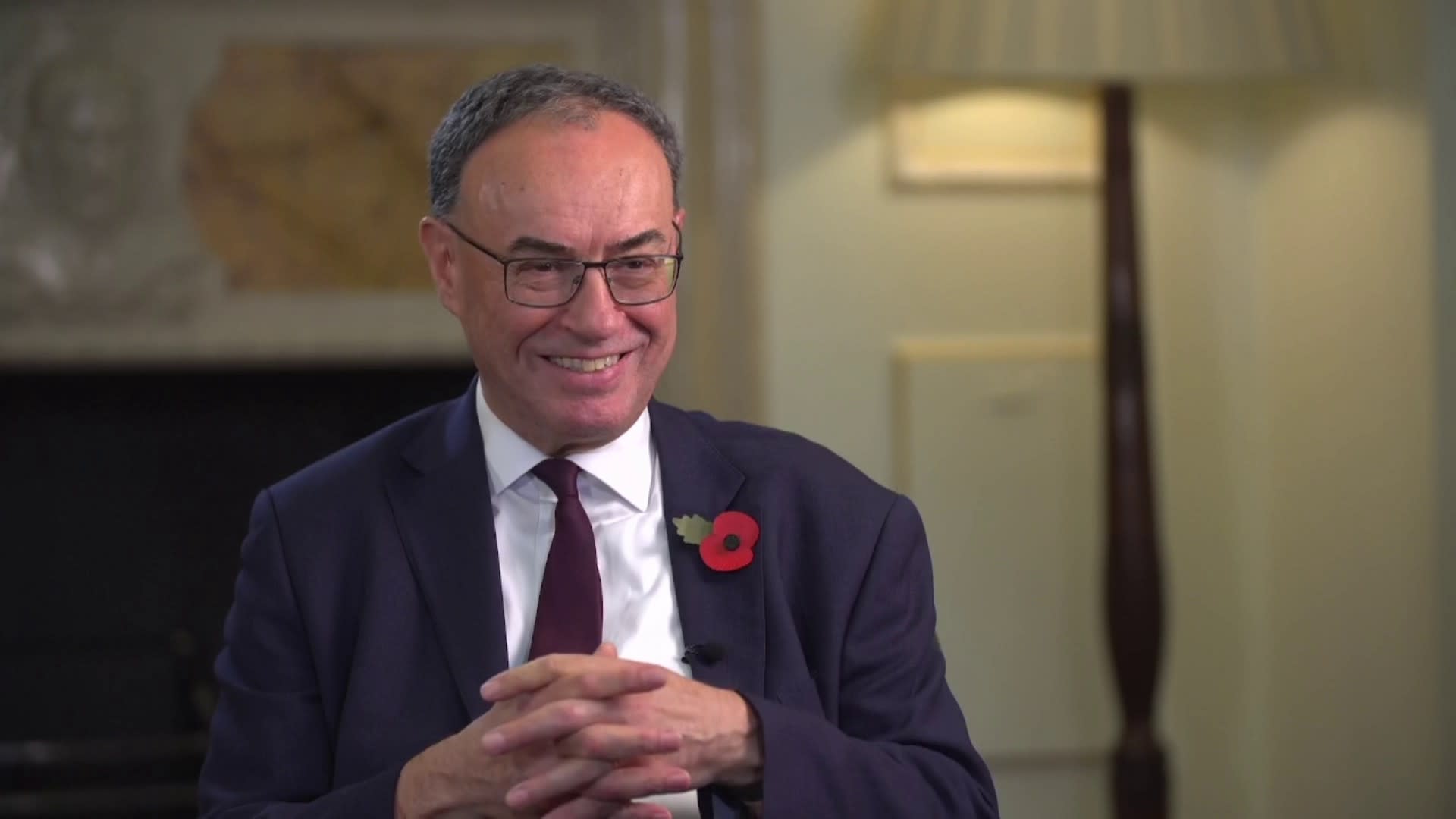

BOE Governor Andrew Bailey signaled to CNBC that rate cuts are coming, with economists now pricing in a pre-Christmas rate cut.

“We’re past peak-restrictiveness, which is what you’d expect given that we’ve cut interest rates five times [since Aug.2024]. For my part, I feel policy is still restrictive, but it’s past peak restriction,” he told CNBC’s Ritika Gupta.

As for the timing of the next cut, Bailey said he would be watching inflation and labor market data that’ll be released before the last monetary policy meeting of the year, on Dec.18.

“I’ll certainly be looking at the rest of this year and the evidence we see between now and our last meeting,” Bailey noted, adding that the MPC would also be able to incorporate Chancellor Rachel Reeves’ budget, due Nov.26, into the central bank’s assessment.

The central bank said in a statement that the inflation rate, at 3.8% in September, had likely peaked and that a disinflationary trend was underway. This was “supported by the still restrictive stance of monetary policy,” it said.

“This is reflected in an easing of pay growth and services price inflation. Underlying disinflation is being underpinned by subdued economic growth and building slack in the labour market,” the bank added.

The BOE cautioned that future rate cuts “will therefore depend on the evolution of the outlook for inflation. If progress on disinflation continues, Bank Rate is likely to continue on a gradual downward path.”

“I think this is the doves winning the argument,” Victoria Clarke, U.K. chief economist at Santander CIB, told CNBC Thursday.

“[BOE Governor Andrew] Bailey has made it clear he wants a bit more data and that was certainly my judgement, that there is a lot of value in waiting for December. You’ve got two more CPI [inflation] prints coming and two more labor market prints and, of course, this massive budget,” she told CNBC’s Decision Time.

Yields on U.K. government bonds fell across the board, with the yield on the benchmark 10-year gilt shedding almost 3 basis points. Meanwhile the British pound trimmed earlier gains to trade 0.18% higher against the U.S. dollar.

The meeting on Thursday was the last one before the Autumn Budget later this month. Economists had said that while they believed the central bank was more likely to hold rates steady, it was not a given.

“It’s not a case of whether they will cut interest rates at some point — the answer to that is yes, we believe they will, “Dean Turner, chief euro zone and U.K. Economist at UBS Global Wealth Management’s Chief Investment Office, had said Tuesday. “If policy is tight, inflation is falling, and growth is lacklustre, then interest rates are going to come down. The hard part is anticipating when,” he added.

Cuts coming

There is a general consensus that rate-setters could trim rates as soon as December, and will cut again over the coming year in response to expected cooling inflation — the rate of which remained unchanged for the third consecutive month in September, at 3.8% — and a softening of labor market data.

Most MPC members are more concerned about the implications of cutting rates too quickly rather than too slowly, Oxford Economics noted in analysis, and the BOE will want to see evidence of sustained downside surprises in the data and pay growth slowing to a target-consistent pace before voting to cut again.

“If we are right and the BOE pauses [this] week, the question will then turn to when the next cut will come,” Allan Monks, chief U.K. economist at JP Morgan, said in a note.

“We have argued that further downside surprises in the inflation and labour market data will determine that. For example, a move up in the unemployment rate to 4.9% in September could be significant, as well as further soft sequential gains in core CPI services and private pay.”

Autumn Budget

The fact the central bank’s meeting this month came ahead of the upcoming Autumn Budget on Nov. 26 was another reason for the BOE’s policy makers to pause for thought.

It’s widely expected that Chancellor Rachel Reeves will announce tax rises as she looks to fill a fiscal black hole estimated to be anywhere between £20-50 billion ($20-$65.2 billion), based on assumed forecasts of lower productivity, servicing debt and the cost of U-turns on welfare spending cuts, among other things.

Earlier this week Reeves gave a clearer indication that tax rises are coming and is she is expected to consider increasing income tax as one way to raise revenues, but she has not given any further detail. Tax rises would likely act as another damper on inflation by reducing consumer demand.

“If the measures [in the budget] include a hike in income tax, they would add to the drag on households’ real incomes from high inflation and slowing pay growth. As these factors weigh on demand inflation will likely ease,” Andrew Wishart, economist at Berenberg, said in a note Friday.

“If so, this will allow the Bank of England to cut interest rates by 25 basis points at least twice next year to 3.50%. A front-loaded fiscal tightening would open the door to a third cut in 2026, to 3.25%,” he added.