US President Donald Trump speaks during a bilateral meeting with Prime Minister of Norway Jonas Gahr Store in the Oval Office of the White House in Washington, DC, on April 24, 2025.

Saul Loeb | Afp | Getty Images

President Donald Trump denied that a strong bond market sell-off influenced his decision earlier this month to hold off on aggressive “reciprocal” tariffs against U.S. trading partners.

“I wasn’t worried,” Trump said in a Time magazine interview during which he was asked about financial market tumult after his April 2 “Liberation Day” announcement.

In the decree, Trump slapped 10% across-the-board duties against all U.S. imports and released a list of tariffs against dozens of other nations. The extra levies were based on trade deficits the U.S. had against the respective countries and raised fears about inflation, a potential recession and disruption of long-held trade agreements.

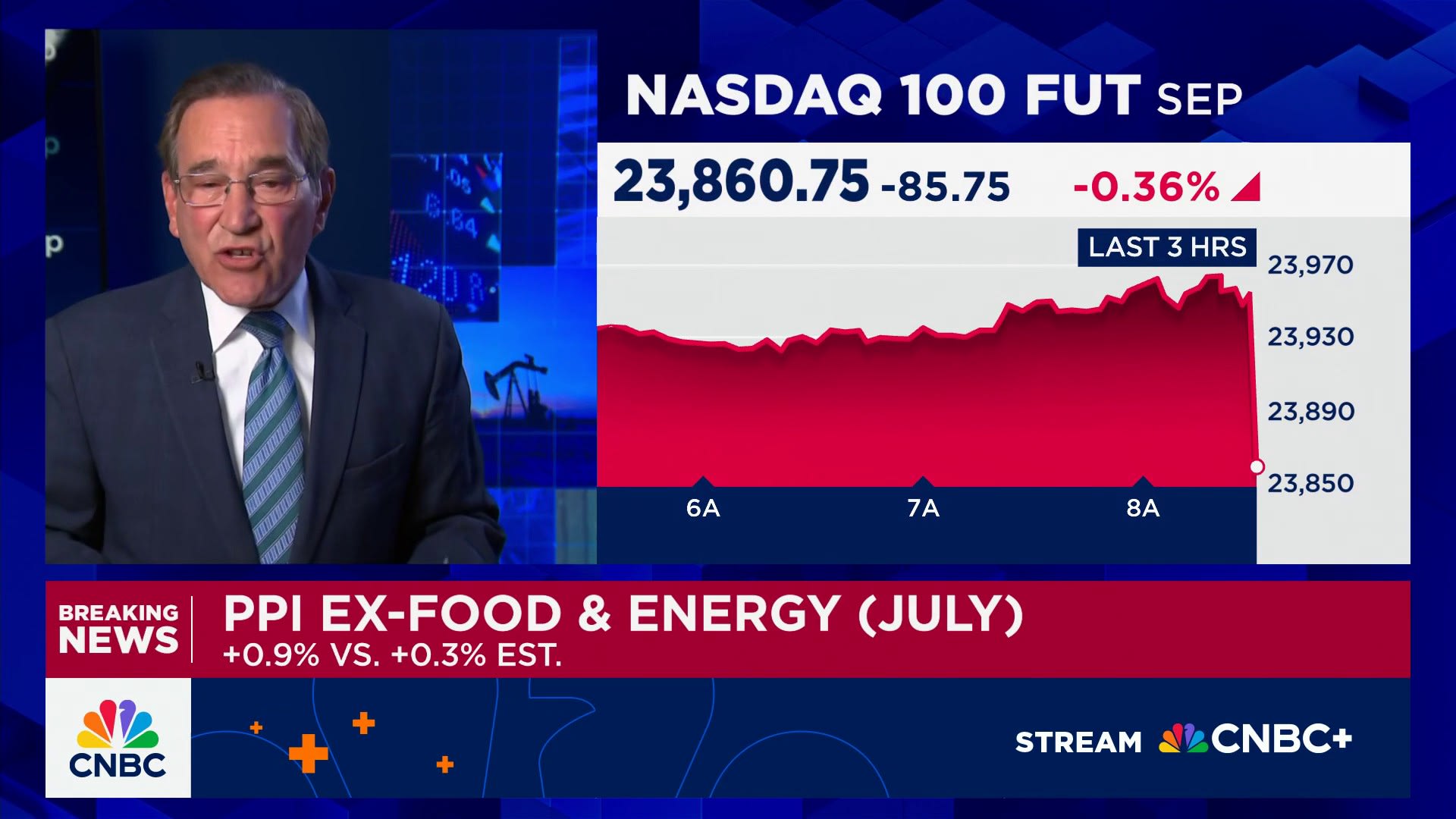

Markets recoiled following the release. Treasury yields initially headed lower but quickly snapped higher. The 10-year yield rose half a percentage point in just a few days, one of its quickest moves ever, as investors also ditched stocks and the U.S. dollar.

Ultimately, Trump issued a 90-day stay on the reciprocal tariffs to allow time for negotiation. But he said it wasn’t because of the market tumult.

“No, it wasn’t for that reason,” Trump told Time in the interview from Tuesday that was published Friday. “I’m doing that until we come up with the numbers that I want to come up with. I’ve met with a lot of countries. I’ve talked on the telephone. I don’t even want them to come in.”

Yields have since moved lower, with the 10-year most recently around 4.28%, about a quarter percentage point higher than its recent low. Trump had said when he made the decision to hold off that the bond market had gotten the “yips.”

“The bond market was getting the yips, but I wasn’t. Because I know what we have,” he said. “I know what we have, but I also know we won’t have it for long if we allowed four more years of the gross incompetence. This thing was just running — it was running as a free spirit. This was — this was the most incompetent president in history.”

Though negotiations over tariffs are ongoing, Trump added that he would consider it a “total victory” even if the U.S. has levies as high as 50% still in place a year from now.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!