The “good ship Transitory,” despite an ominous record, appears ready to sail again for the Federal Reserve.

Economic projections the central bank released Wednesday indicate that while officials see inflation moving up this year more rapidly than previously expected, they also expect the trend to be short-lived. The outlook spurred talk again about “transitory” inflation that caused a major policy headache for the Fed.

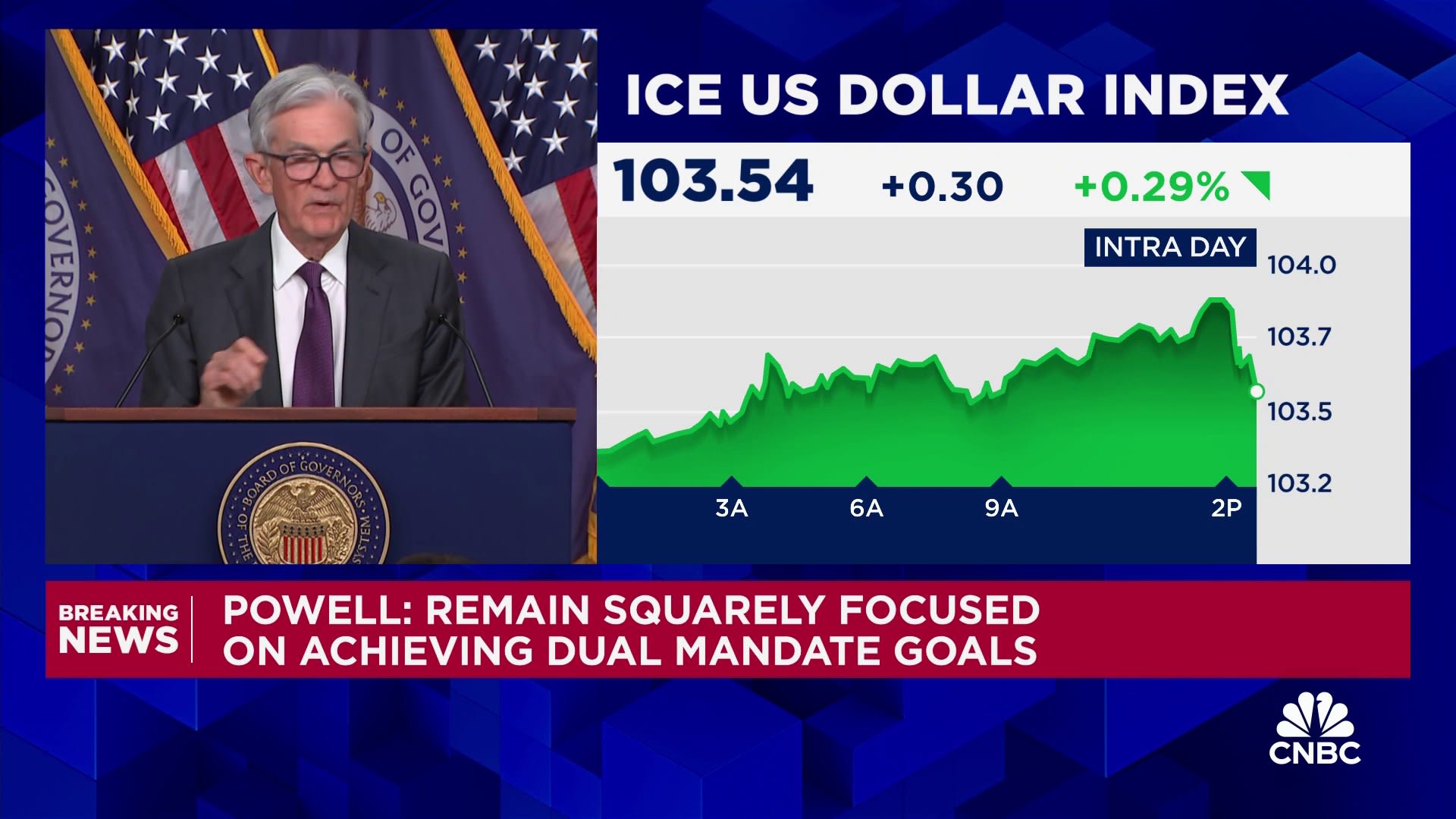

At his post-meeting news conference, Chair Jerome Powell said the current outlook is that any price jumps from tariffs likely will be short-lived.

Asked if the Fed is “back at transitory again,” the central bank leader responded, “So I think that’s kind of the base case. But as I said, we really can’t know that. We’re going to have to see how things actually work out.”

However, the Federal Open Market Committee outlook, with inflation hitting 2.8% in 2025 but quickly receding back to 2.2% then 2% in the succeeding years, indicates that officials do not expect a lasting burden from the tariffs.

“It can be the case that it’s appropriate sometimes to look through inflation, if it’s going to go away quickly, without action by us, if it’s transitory,” Powell said. “That can be the case in the case of tariff inflation. I think that would depend on the tariff inflation moving through fairly quickly and, critically, as well on inflation expectations being well anchored.”

Powell added that while sentiment surveys show some short-term inflation indicators have risen, market-based measures for longer-run expectations are well-anchored.

Worries over tariffs

The position is significant with markets concerned that President Donald Trump’s tariffs could spark a broader global trade war that again would make inflation a problem for the U.S. economy. Inflation had appeared to be on the run heading into this year, but the outlook is less certain now.

Back in 2021, when inflation first rose past the Fed’s 2% target, Powell and his colleagues repeatedly said they expected the move to be transitory, brought on by Covid-specific factors impacting supply and demand that ultimately would fade. However, inflation kept rising, eventually hitting 9% as measured by the consumer price index, and the Fed was forced to respond with a series of aggressive interest rate hikes not seen since the early 1980s.

In a speech last August at the Fed’s annual Jackson Hole summit, Powell even joked that “the good ship Transitory was a crowded one,” and he told attendees that “I think I see some former shipmates out there today.”

The room chuckled at Powell’s remarks, and the market Wednesday didn’t seem to mind the transitory talk. Stocks jumped as Powell spoke, and the Dow Jones Industrial Average closed up 383 points to 41,964, a reversal of fortune for a market in decline lately.

“‘Transitory’ is back, or at least that was the insinuation,” said Elyse Ausenbaugh, head of investment strategy at J.P. Morgan Wealth Management. “The market reaction, to me, says that investors are willing to believe that tariffs and other policies won’t create lasting inflationary pressures and that the Fed can stay in control.”

The Fed voted to keep its benchmark interest rate on hold as it weighs the impact of tariffs and fiscal policy from Trump. In addition, Federal Open Market Committee officials indicated that two more quarter percentage point rate cuts could be on the way this year, though Powell cautioned again that policy is not locked in, nor is the transitory inflation view on tariffs.

“We will be watching all of it very, very carefully. We do not take anything for granted,” he said.