The Federal Reserve is poised to deliver its third straight interest rate cut Wednesday, while simultaneously firing a warning shot about what’s ahead.

Following a period of remarkable indecision about which way central bank policymakers would lean, markets have settled on a quarter percentage point reduction. If that’s the case, it will take the Fed’s key interest rate down to a range of 3.5%-3.75%.

However, there are complications.

The rate-setting Federal Open Market Committee is split between members who favor cuts as a way to head off further weakness in the labor market against those who think easing has gone far enough and threatens to aggravate inflation.

That’s why the term “hawkish cut” has become the buzzy term for this meeting. In market parlance, it refers to a Fed that will reduce, but deliver a message that no one should be holding their breath for the next one.

“The likeliest outcome is a kind of hawkish cut where they cut, but the statement and the press conference suggesting that they may be done cutting for now,” said Bill English, the Fed’s former director of monetary affairs and now a Yale professor.

English expects the message to be “that they’ve made an adjustment and they’re comfortable where they are, and they don’t see a need to do anything more in the near term, as long as things play out more or less as they expect.”

Where the full committee falls will be expressed in the post-meeting statement and Chair Jerome Powell’s news conference. Wall Street economic commentary anticipates a tweak in the statement to harken back to a year ago with language regarding “the extent and timing of additional adjustments” that Goldman Sachs expects to reflect “the bar for any further cuts will be somewhat higher.”

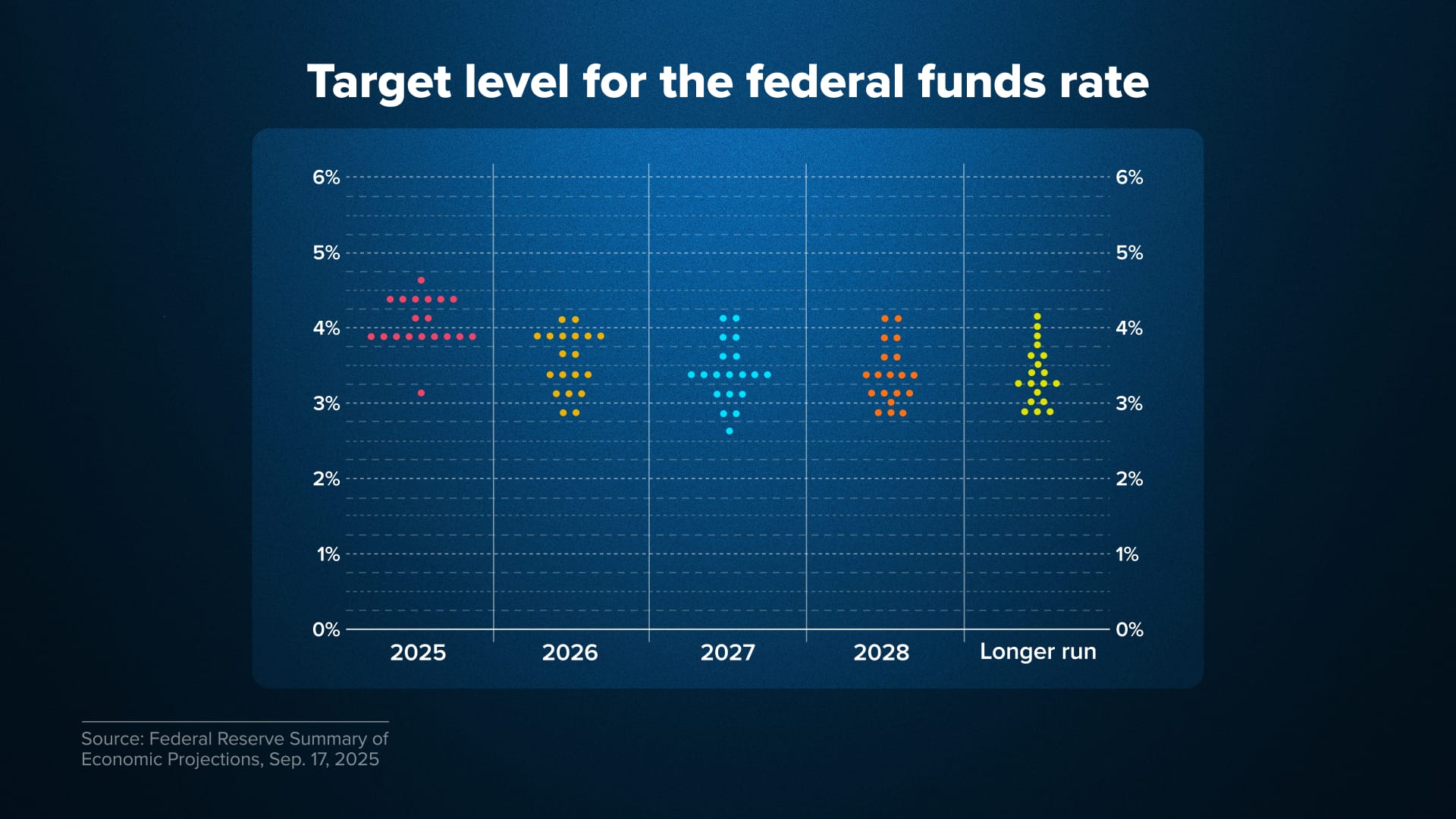

In addition to the rate decision and the statement, investors will be watching an update to the “dot plot” of individual officials’ rate expectations; expectations for gross domestic product, unemployment and inflation, and a possible update of the Fed’s asset purchase intentions, with some expecting the committee to pivot from ceasing the runoff of maturing bond proceeds back to purchases.

Many moving parts

As for Powell, his tone “will also likely get across that the bar has risen in his press conference and will likely again make a point of explaining the views of participants who opposed a cut,” Goldman economist David Mericle said in a note.

About that dissent: The October meeting saw two “no” votes on the final statement, one from each side of the rate debate. Mericle said that is likely to happen again, accompanied by multiple other “soft dissents” who will represent divergent views on the “dot plot” that indicates, anonymously, the rate outlook for each of 19 individual meeting participants, a group that includes 12 voters.

While Mericle added that there is a “solid case” for a third cut, there are arguments to be made for both sides.

“It’s a tough meeting, and so they’ll presumably be a few dissents,” English said. “It’s often hard to get the committee together. You have people who just have very different views about how the economy works and how policy works and so on. But this moment for the economy is particularly fraught.”

Even with the dearth of official government data due to the since-settled shutdown, hiring has shown signs of flattening, with sporadic signals that layoffs are accelerating. A Bureau of Labor Statistics report Tuesday showed job openings little changed in October but hiring down by 218,000 and layoffs rising by 73,000.

On the inflation side, the most recent reading of the Fed’s preferred gauge showed the annual rate at 2.8% in September, slightly below the Wall Street forecast but still well above the central bank’s 2% goal.

Inflation worries

Despite President Donald Trump’s protestations that inflation has disappeared, it has at best stabilized and at worst is holding above the Fed’s target in part due to the tariffs implemented under his watch. While Fed officials mostly have said they expect the duties to provide a temporary boost to prices, the gap between the current level and the central bank goal is enough to give some economists and policymakers pause.

“Inflation is not back to 2% so they’re going to need to keep policy somewhat restrictive if they are going to put downward pressure on inflation,” former Cleveland President Loretta Mester said Tuesday on CNBC. “Right now, inflation is pretty well above the goal, and it’s not just all tariff-driven.”

Still, Mester thinks the FOMC will approve one more cut Wednesday.

Like market participants, Mester saw a Nov. 21 speech from New York Fed President John Williams as the pivotal sign “quite clearly” that another reduction was coming. Prior to that, markets had been betting against a cut, particularly after Powell said explicitly at his October news conference that a December move was not a “foregone conclusion. Far from it.”

“I think they’re going to follow through with that last cut,” Mester said. “I do hope that they signal that they think the economy has gotten to a place where policy is in a good place and they are going to slow down the cuts, because I am more concerned about the inflation risk, the stickiness.”

Aside from rate questions and the dot plot update, the committee may signal its next step regarding management of its balance sheet.

The committee in October signaled that it would halt the process of “quantitative tightening,” or allowing maturing bond proceeds to roll off. With pressures ongoing in the overnight funding markets, some market participants expect the Fed will announce it will resume bond purchases, though not a pace that would suggest the “quantitative easing,” or QT’s opposite.