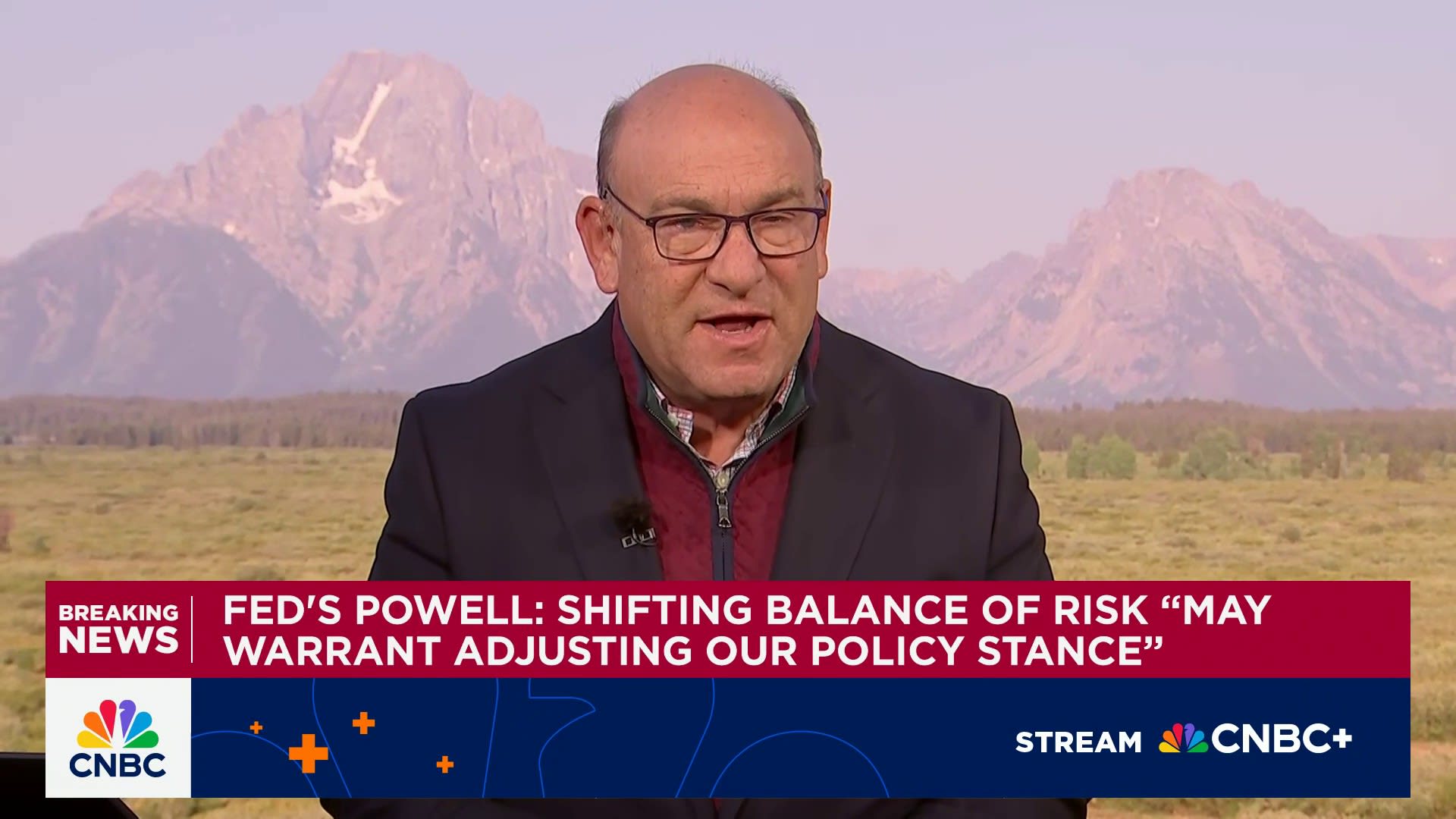

Federal Reserve Chair Jerome Powell on Friday gave a tepid indication of possible interest rate cuts ahead as he noted a high level of uncertainty that is making the job difficult for monetary policymakers.

In his much-anticipated speech at the Fed’s annual conclave in Jackson Hole, Wyoming, the central bank leader in prepared remarks cited “sweeping changes” in tax, trade and immigration policies. The result is that “the balance of risks appear to be shifting” between the Fed’s twin goals of full employment and stable prices.

Watch Powell deliver his remarks live

While he noted that the labor market remains in good shape and the economy has shown “resilience,” he said downside dangers are rising. At the same time, he said tariffs are causing risks that inflation could rise again — a stagflation scenario that the Fed needs to avoid.

With the Fed’s benchmark interest rate a full percentage point below where it was when Powell delivered his keynote a year ago, and the unemployment rate still low, conditions allow “us to proceed carefully as we consider changes to our policy stance,” Powell said.

“Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” he added.

That was as close as he came during the speech to endorsing a rate cut that Wall Street widely believes is coming when the Federal Open Market Committee next meets Sept. 16-17.

However, the remarks were enough to send stocks soaring and Treasury yields tumbling. The Dow Jones Industrial Average showed a gain of more than 600 points following the public release of Powell’s speech while the policy-sensitive 2-year Treasury note saw a 0.08 percentage point fall to around 3.71%.

In addition to market expectations, President Donald Trump has demanded aggressive cuts from the Fed in scathing public attacks he has lobbed at Powell and his colleagues.

The Fed has held its benchmark borrowing rate in a range between 4.25%-4.5% since December. Policymakers have continued to cite the uncertain impact that tariffs will have on inflation as a reason for caution and believe that current economic conditions and the slightly restrictive policy stance allow for time to make further decisions.

Importance of Fed independence

While not addressing the White House demands for lower rates specifically, Powell did note the importance of Fed independence.

“FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach,” he said.

The speech comes amid ongoing negotiations between the White House and its global trading partners, a situation often in flux and without clarity on where it will end. Recent indicators show consumer prices gradually pushing higher but wholesale costs up more rapidly.

From the Trump administration’s view, the tariffs will not cause lasting inflation, thus warranting rate cuts. Powell’s position in the speech was that a range of outcomes is possible, with a “reasonable base case” being that the tariff impacts will be “short lived — a one-time shift in the price level” that likely would not be cause for holding rates higher. However, he said nothing is certain at this point.

“It will continue to take time for tariff increases to work their way through supply chains and distribution networks,” Powell said. “Moreover, tariff rates continue to evolve, potentially prolonging the adjustment process.”

In addition to summarizing the current conditions and potential outcomes, the speech touched on the Fed’s five-year review of its policy framework. The review resulted in several notable changes from when the central bank last performed the task in 2020.

At that time, in the midst of the Covid pandemic, the Fed switched to a “flexible average inflation targeting” regime that effectively would allow inflation to run higher than the central bank’s 2% goal coming after a prolonged period of holding below that level. The upshot is that policymakers could be patient with slightly higher inflation if it meant insuring a more comprehensive labor market recovery.

However, shortly after adopting the strategy, inflation began to climb, ultimately hitting 40-year highs, while policymakers largely dismissed the rise as “transitory” and not needing rate hikes. Powell noted the damaging impacts from the inflation and the lessons learned.

“As it turned out, the idea of an intentional, moderate inflation overshoot had proved irrelevant. There was nothing intentional or moderate about the inflation that arrived a few months after we announced our 2020 changes to the consensus statement, as I acknowledged publicly in 2021,” Powell said. “The past five years have been a painful reminder of the hardship that high inflation imposes, especially on those least able to meet the higher costs of necessities.”

Also during the review, the Fed reaffirmed its commitment to its 2% inflation target. There have been critics on both sides of the issue, with some suggesting the rate is too high and can lead to a weaker dollar, while others seeing a need for the central bank to be flexible.

“We believe that our commitment to this target is a key factor helping keep longer-term inflation expectations well anchored,” Powell said.