Job creation sputtered in August, adding to recent signs of labor market weakening and likely keeping the Federal Reserve on track for a widely anticipated interest rate cut later this month.

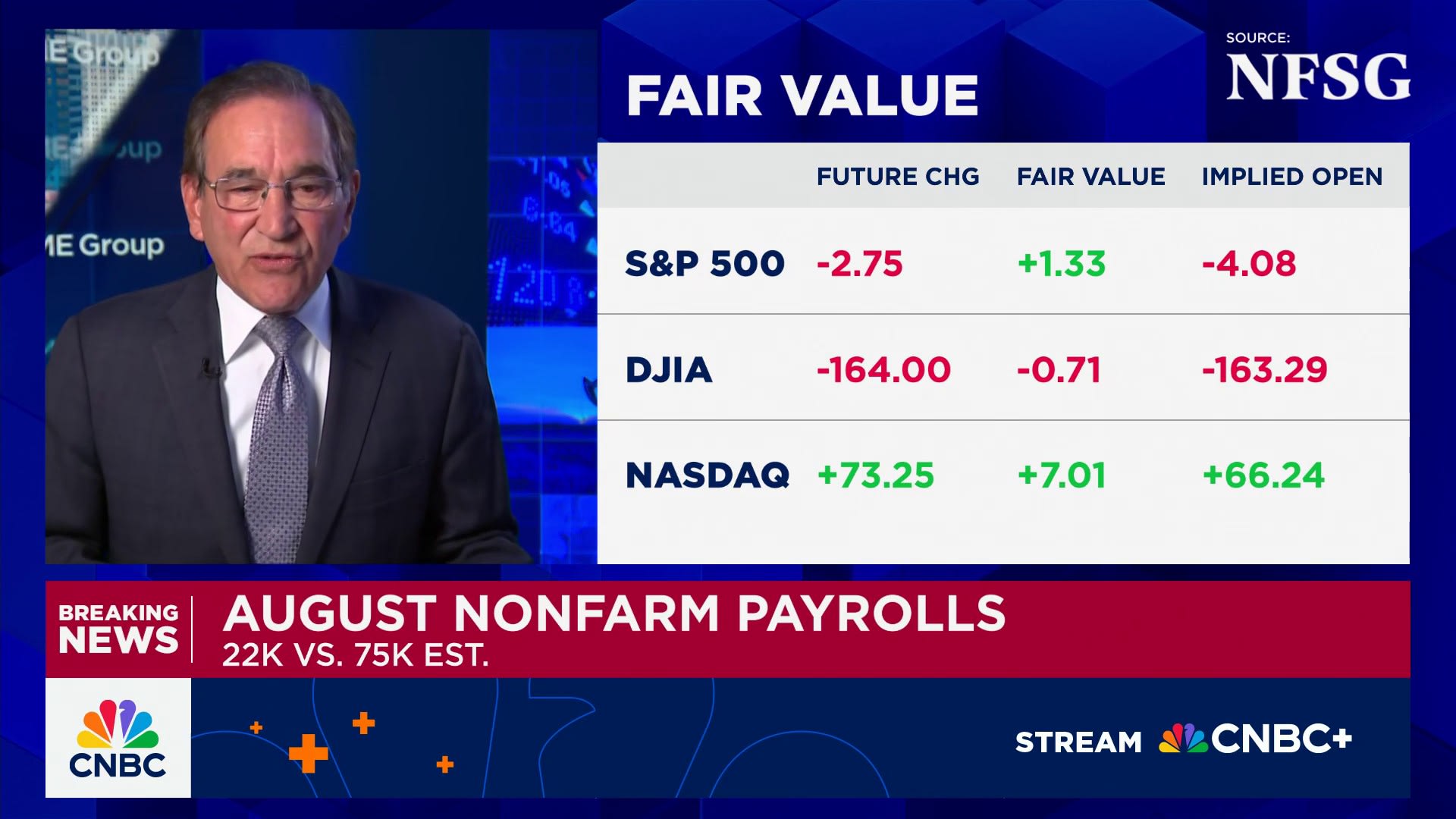

Nonfarm payrolls increased by just 22,000 for the month, while the unemployment rate rose to 4.3%, according to a Bureau of Labor Statistics report Friday. Economists surveyed by Dow Jones had been looking for payrolls to rise by 75,000.

The report showed a marked slowdown from the July increase of 79,000, which was revised up by 6,000. Revisions also showed a net loss of 13,000 in June after the prior estimate was lowered by 27,000.

“The job market is stalling short of the runway,” said Daniel Zhao, chief economist at jobs site Glassdoor. “The labor market is losing lift, and August’s report, along with downward revisions, suggests we’re heading into turbulence without the soft landing achieved.”

Markets largely disregarded the report, with stocks up at the open and Treasury yields sharply lower. Traders in the futures markets raised the probability of a quarter percentage point Fed rate cut to 100% and went even further, pricing in a 12% probability of a half-point move, according to the CME Group’s FedWatch gauge.

The payrolls count was the first since President Donald Trump fired former BLS Commissioner Erika McEntarfer following the release of the July jobs report a month ago. The move came after the report showed not just a weak level of job creation but also dramatic reductions in previous months’ totals.

In McEntarfer’s place, the president nominated economist E.J. Antoni, a Trump loyalist from the Heritage Foundation who previously had criticized the BLS numbers as being politically distorted. William Wiatrowski is serving as acting BLS commissioner.

While the pace of hiring was slow, average hourly earnings increased 0.3% for the month, meeting the estimate, though the annual gain of 3.7% was slightly below the forecast for 3.8%.

Hiring was held back by a payroll reduction in the federal government, which reported a decline of 15,000.

Health care again led sectors, adding 31,000 jobs, while social assistance contributed 16,000. Wholesale trade and manufacturing both saw declines of 12,000 on the month.

The report comes as markets widely expect the Fed to lower its benchmark interest rate by a quarter percentage point when it releases its next decision Sept. 17. Fed Chair Jerome Powell and his fellow policymakers also have been under heavy criticism from the president as they have been on hold since last cutting in December 2024.

Though most economic indicators indicate continued expansion, Fed officials have expressed concern about a slowdown in hiring even as layoffs have held fairly steady. At the same time, policymakers worry that Trump‘s tariffs could reignite inflation, with data indicating a slow but steady increase in prices over recent months.

“The warning bell that rang in the labor market a month ago just got louder. A weaker-than-expected jobs report all but seals a 25-basis-point rate cut later this month,” said Olu Sonola, head of U.S. economic research at Fitch Ratings. “Four straight months of manufacturing job losses stand out. It’s hard to argue that tariff uncertainty isn’t a key driver of this weakness.”

While the establishment survey showed weak job creation, the more volatile household count, used to calculate the unemployment rate, held better news.

That report showed an increase of 288,000 employed, though the ranks of the unemployed also rose by 148,000. The labor force participation rate edged higher to 62.3% while the labor force swelled by 436,000, accounting for the tick higher in the unemployment rate.

A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons climbed to 8.1%, a 0.2 percentage point increase and the highest level since October 2021.

Along with the jobs numbers tally, the BLS on Tuesday will release the initial estimate for annual benchmark revisions to the numbers dating back one year from March 2025.

Revisions have been a source of controversy, particularly in the post-Covid era as the response rate has declined, particularly for the headline establishment survey that asks businesses and government agencies to detail the pace of hiring.

The BLS typically releases its initial estimate with the first batch of survey responses it gets, then updates two times as it gets more information. However, Trump has accused the BLS of being politically biased. The firing of McEntarfer drew widespread criticism in the economics and markets community.

In a CNBC interview, National Economic Council Director Kevin Hassett said he expects the August payrolls count to get revised higher. In the past three years, the initial August count actually was revised lower from the initial estimate.

Correction: The BLS on Tuesday will release the initial estimate for annual benchmark revisions to the numbers dating back one year from March 2025. An earlier version misstated the timing.