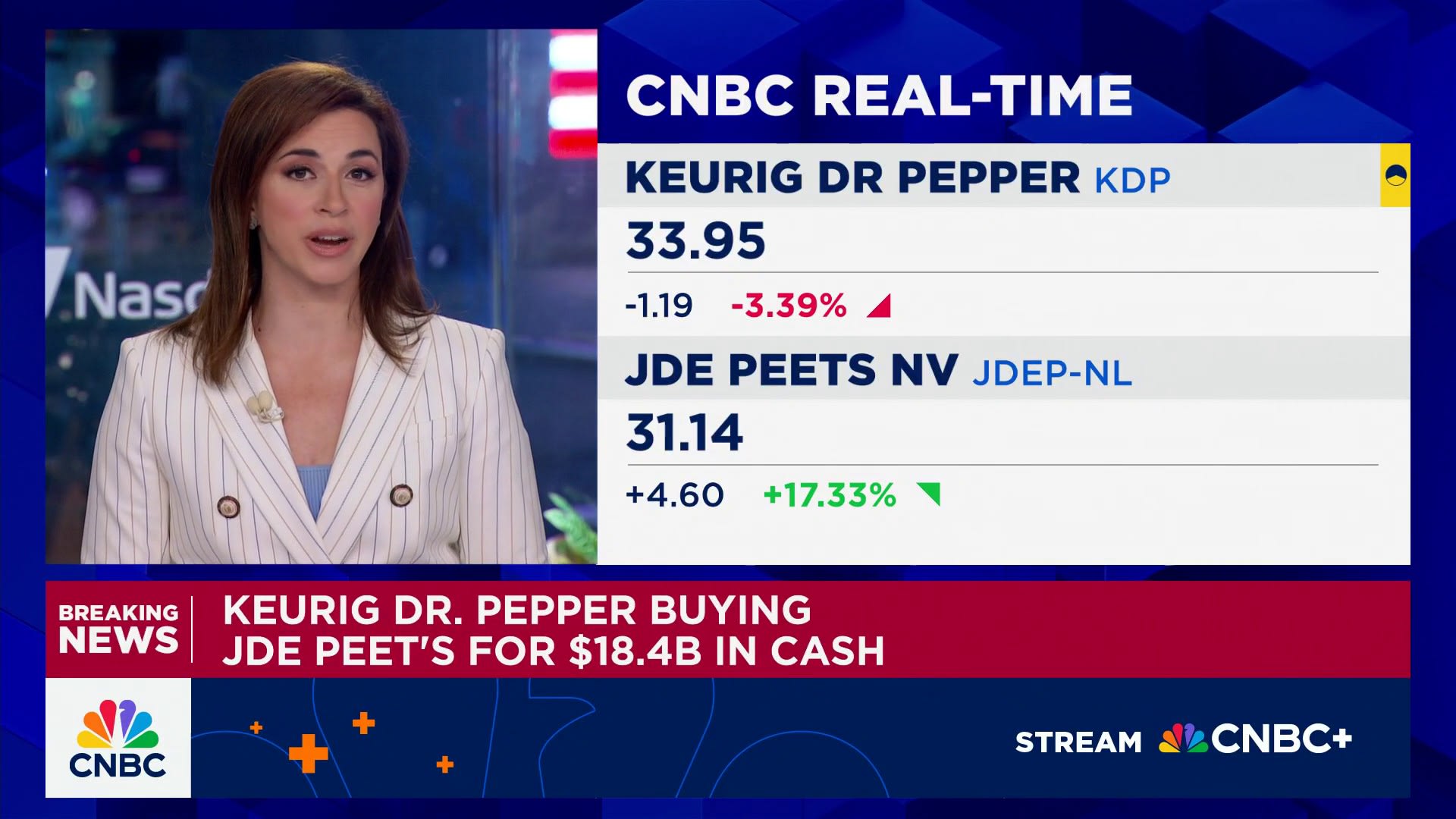

Keurig Dr Pepper will acquire Dutch coffee and tea company JDE Peet’s in a roughly $18 billion deal that could give a boost to the U.S. giant’s struggling coffee business, the two companies said Monday.

Shares of Keurig Dr Pepper fell roughly 8% in early trading, while the stock of JDE Peet’s climbed 17%, on pace for its best day ever.

The deal was first reported by The Wall Street Journal.

Keurig Dr Pepper will pay JDE Peet’s shareholders 31.85 euros ($37.3) per share in cash, representing a 33% premium on the Dutch’s firm’s 90-day volume-weighted average stock price, which represents a total equity purchase of 15.7 billion euros ($18.4 billion). JDE Peet’s will, meanwhile, pay out a previously declared dividend of 0.36 euros per share prior to the deal closing.

The takeover is expected to generate $400 million in cost synergies over three years.

Keurig Dr Pepper, which owns brands such as Dr Pepper, 7Up, Snapple and Green Mountain Coffee, has seen shrinking sales at its U.S. coffee division, down 0.2% to $900 million in the second quarter due to a decline in the shipments of its single-serve coffee pods and Keurig coffee makers.

Keurig Dr Pepper has been looking to raise its appeal with thrifty shoppers who prefer to drink their coffee at home, while also venturing into cold coffee offerings in a bid to attract the Starbucks and Dunkin’ clientele.

In addition to their coffee businesses, Keurig Dr Pepper and JDE Peet’s also have a shared history with JAB Holding, the investment arm of the Reimann family that at one time owned both companies. These days, JAB owns just 4.4% of KDP and no longer has any seats on its board, although it is still the majority owner of JDE Peet’s.

Following the JDE Peet’s acquisition, which is expected to occur in the first half of 2026, Keurig Dr Pepper intends to split up its beverage and coffee units as two separate, U.S.-listed companies at the earliest opportunity. Such a step would effectively unwind the 2018 merger between Keurig and Dr Pepper Snapple, which at the time created the third-largest beverage company in North America with roughly $11 billion in annual revenues.

“Frankly the surprise to us was the decision back in 2018 when Keurig Green Mountain acquired the Dr Pepper Snapple Group in an $18.7 billion deal to create Keurig Dr Pepper in the first place,” Barclays analysts Patrick Folan and Lauren Lieberman wrote in a note to clients on Monday. “At the time, it was seen as both odd and a very left field deal with the questionable logic of combining coffee and [carbonated soft drinks].”

After the division, the resulting coffee company is anticipated to turn $16 billion in combined annual net sales and will be led by current Keurig Dr Pepper Chief Financial Officer Sudhanshu Priyadarshi.

The beverages firm is, meanwhile, expected to have $11 billion in annual net sales and will be helmed, upon separation, by incumbent Keurig Dr Pepper CEO Tim Cofer.

JDE Peet’s CEO, Rafael Oliveira, will stay in his post to helm the Dutch coffee company until the acquisition closes.

Faced with fierce competition and volatile commodity prices, Keurig Dr Pepper isn’t the only the company looking to spin off its coffee business. Sky News reported on Saturday that Coca-Cola is exploring a sale of Costa Coffee, which it bought in 2018 for $5.1 billion.

— CNBC’s Victor Loh contributed to this report.