Federal Reserve officials in January agreed they would need to see inflation come down more before lowering interest rates further, and expressed concern about the impact President Donald Trump

Policymakers on the Federal Open Market Committee unanimously decided at the meeting to hold their key policy rate steady after three consecutive cuts totaling a full percentage point in 2024.

In reaching the decision, members commented on the potential impacts from the new administration, including chatter about the tariffs as well as the impact from reduced regulations and taxes. The committee noted that current policy is “significantly less restrictive” than it had been before the rate cuts, giving members time to evaluate conditions before making any additional moves.

Members said that the current policy provides “time to assess the evolving outlook for economic activity, the labor market, and inflation, with the vast majority pointing to a still-restrictive policy stance. Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate.”

Officials noted concerns they had about the potential for policy changes to keep inflation above the Fed’s target.

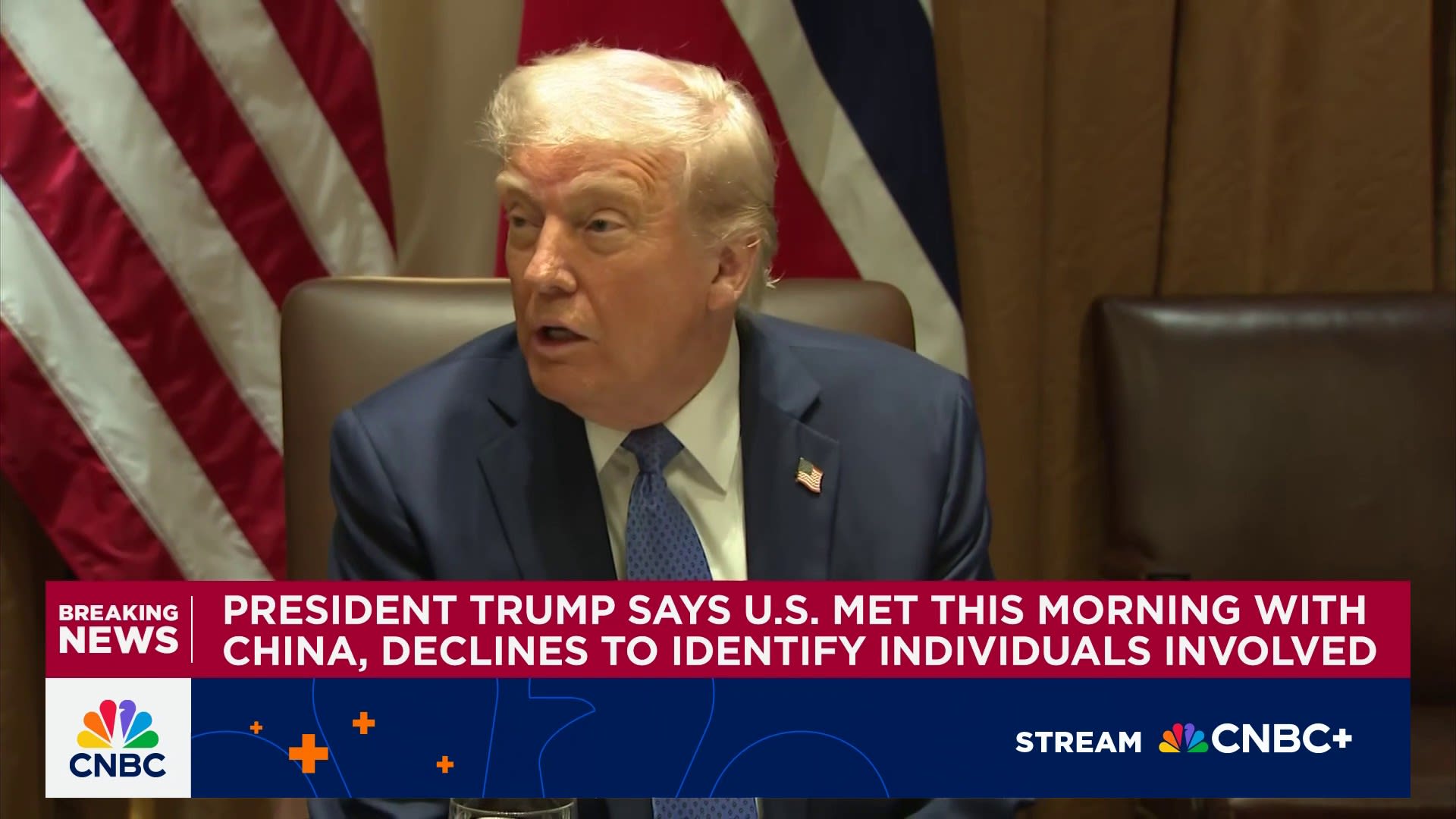

The president already has instituted some tariffs but in recent days has threatened to expand them.

In remarks to reporters Tuesday, Trump said he is looking at 25% duties on autos, pharmaceuticals and semiconductors that would accelerate through the year. While he did not delve too far into specifics, the tariffs would take trade policy to another level and pose further threats to prices at a time when inflation has eased but is still above the Fed’s 2% goal.

FOMC members cited, according to the meeting summary, “the effects of potential changes in trade and immigration policy as well as strong consumer demand. Business contacts in a number of Districts had indicated that firms would attempt to pass on to consumers higher input costs arising from potential tariffs.”

They further noted “upside risks to the inflation outlook. In particular, participants cited the possible effects of potential changes in trade and immigration policy.”

Since the meeting, most central bank officials have spoken in cautious tones about where policy is headed from here. Most view the current level of rates in a position where they can take their time when evaluating how to proceed.

In addition to the general focus Fed officials put on employment and inflation, Trump’s plans for fiscal and trade policies have added a wrinkle into the considerations.

On the flip side of worries over tariffs and inflation, the minutes noted “substantial optimism about the economic outlook, stemming in part from an expectation of an easing in government regulations or changes in tax policies.”

Many economists expect tariffs that Trump plans on launching to aggravate inflation, though Fed policymakers have said their response would be dependent on whether they are one-time increases or if they generate more underlying inflation that would necessitate a policy response.

Inflation indicators lately have been mixed, with consumer prices rising more than expected in January but wholesale prices indicating softer pipeline pressures.

Fed Chair Jerome Powell has generally avoided speculation on the impact the tariffs would have. However, other officials have expressed concern and conceded that Trump’s moves could impact policy, possibly delaying rate cuts further. Market pricing currently is anticipating the next reduction to come in July or September.

The Fed’s benchmark overnight borrowing rate is currently targeted between 4.25%-4.5%.