An end of an era was announced in Omaha Saturday as Warren Buffett said he will soon ask the board of Berkshire Hathaway to have Greg Abel replace him as CEO at year end.

While Buffett is 94 and Abel was designated as CEO successor in 2021, it nonetheless came as a surprise to the thousands of admiring shareholders gathered for this year’s annual meeting to once again hear the investing legend opine on the future of the company.

“Tomorrow, we’re having a board meeting of Berkshire, and we have 11 directors. Two of the directors, who are my children, Howie and Susie, know of what I’m going to talk about there. The rest of them, this will come as news to, but I think the time has arrived where Greg should become the chief executive officer of the company at year end,” said Buffett, in the final few minutes of the meeting.

In 1965, Buffett bought what was then a failing New England textile mill, and over six decades transformed the company into a one-of-a-kind conglomerate with businesses ranging from Geico insurance to BNSF Railway. Buffett is handing over his reins on a high note as Berkshire shares just reached a new peak, giving the conglomerate a market cap of nearly $1.2 trillion.

The “Oracle of Omaha” said he will still “hang around” to help, but the final word on company operations and capital deployment would be with Abel, 62, currently the vice chairman of non-insurance operations for Berkshire.

Warren Buffett and Greg Abel walkthrough the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025.

David A. Grogen | CNBC

“I could be helpful, I believe, in that in certain respects, if we ran into periods of great opportunity or anything,” he added.

Buffett, who owns more than $160 billion in Berkshire as its largest shareholder, said he wouldn’t sell a single share of the stock after he transitions to this new phase.

“I would add this, the decision to keep every share is an economic decision because I think the prospects of Berkshire will be better under Greg’s management than mine,” said Buffett, who used a cane to walk around the meeting, but answered questions for four hours with surprising energy and clarity for his age.

Buffett sang Abel’s praises in front of some 40,000 shareholders Saturday, saying his more hands-on managerial style is working better for Berkshire’s 60-plus subsidiaries.

“It’s working way better with Greg than with me because, you know, I didn’t want to work as hard as he works,” Buffett said. “I could get away with it because we’ve got a basically good business, very good business.”

The Canadian executive, born in Edmonton, Alberta, has a 25-year tenure at Berkshire under his belt. Abel joined Berkshire in 2000 when the conglomerate bought MidAmerican Energy, where he eventually became the CEO in 2008. Prior to that, Abel worked at CalEnergy where he transformed the small geothermal firm into a diversified energy business.

When it comes to capital allocation, Abel said he will carry on Buffett’s patient value investing style and he stands ready to deploy Berkshire’s monstrous $347 billion cash fortress whenever a good opportunity presents itself.

“It’s really the investment philosophy and how Warren and the team have allocated capital for the past 60 years,” Abel said. “Really, it will not change. And it’s the approach we’ll take as we go forward.”

Buffett’s new role?

Buffett and Abel told CNBC’s Becky Quick after the shareholder meeting that the pair would discuss at the Sunday board meeting what Buffett’s role will be formally next year. Buffett is currently also chairman of the conglomerate.

“I think they’ll be unanimously in favor of it,” Buffett said of the board’s pending CEO decision Sunday.

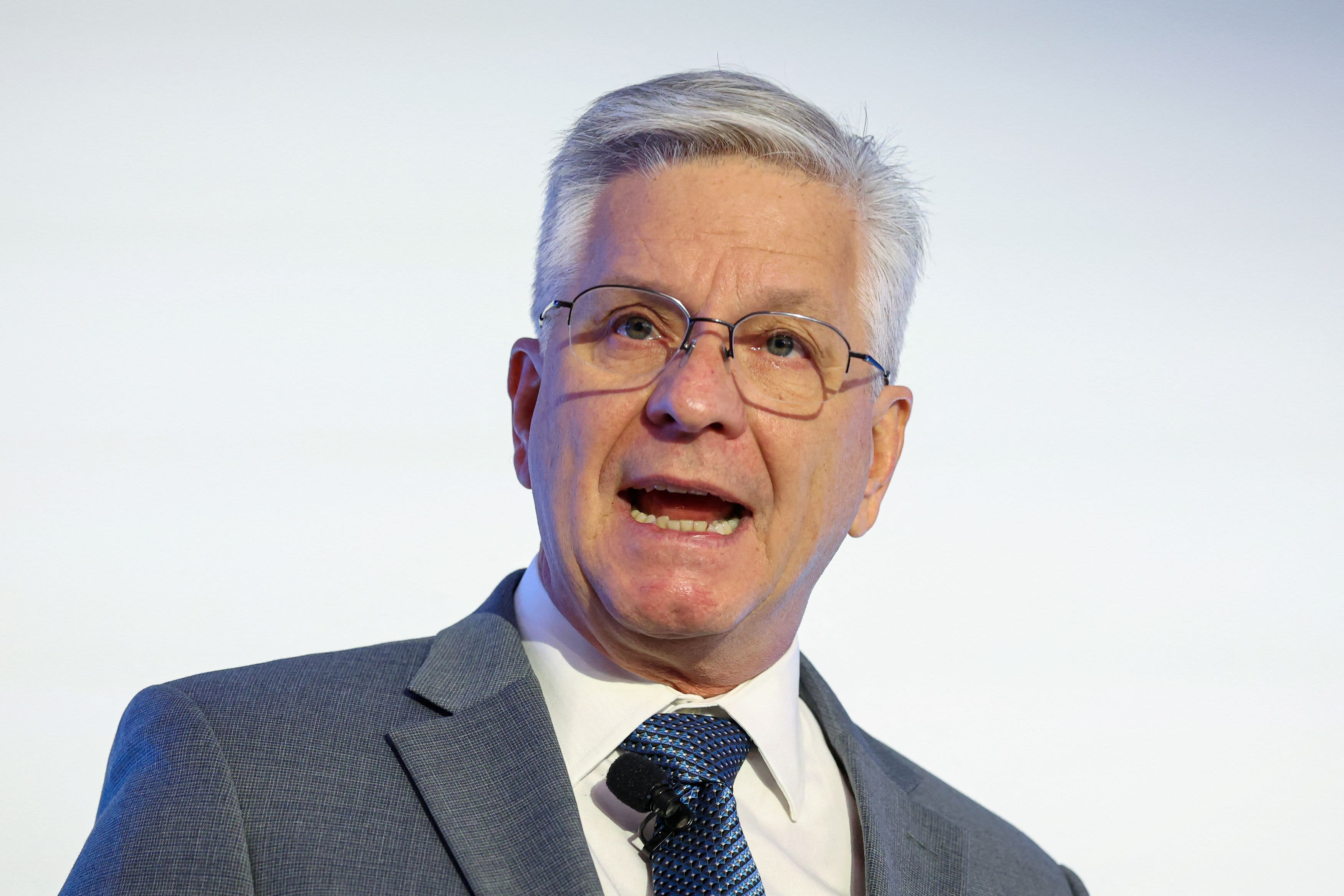

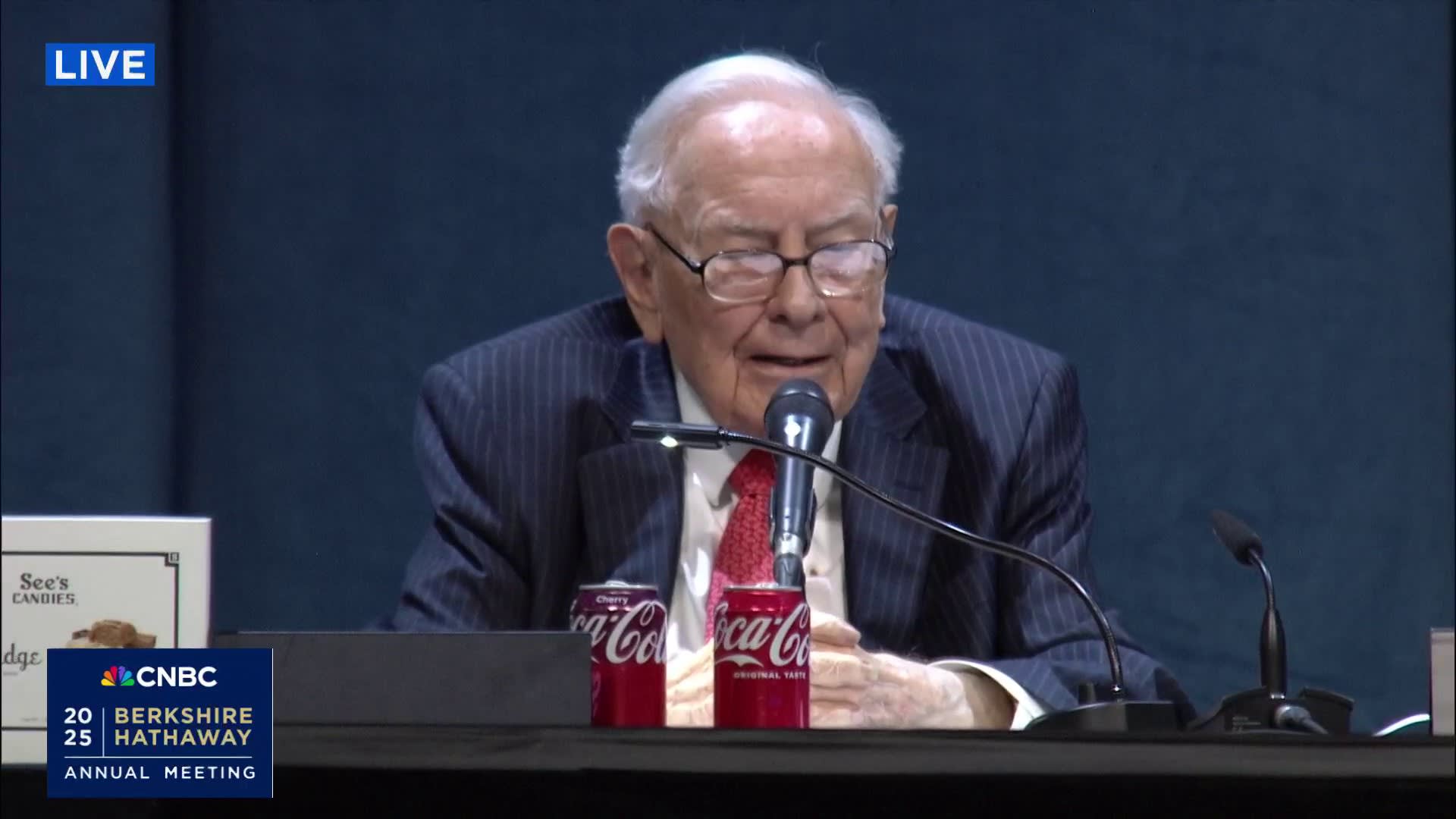

Warren Buffett speaks during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025.

CNBC

So it’s not clear whether Abel will also assume the chairman role. Buffett told The Wall Street Journal earlier this year that his son Howie Buffett would become nonexecutive chairman after his death to preserve the company culture. It’s not clear whether this move will impact that decision.

“It surprises me, but it impresses me,” said Ron Olson a Berkshire board director, after the shareholder meeting Saturday. “I am very anxious to see Warren become the Charlie Munger for Greg Abel.”

After the announcement that apparently Abel didn’t even know was coming, the meeting ended with a standing ovation for Buffett.

The crowd reacts during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025.

CNBC

— With reporting by Lisa Kailai Han and Fred Imbert