A widely followed measure of inflation accelerated slightly less than expected in July on an annual basis as President Donald Trump

The consumer price index increased a seasonally adjusted 0.2% for the month and 2.7% on a 12-month basis, the Bureau of Labor Statistics reported Tuesday. That compared with the respective Dow Jones estimates for 0.2% and 2.8%.

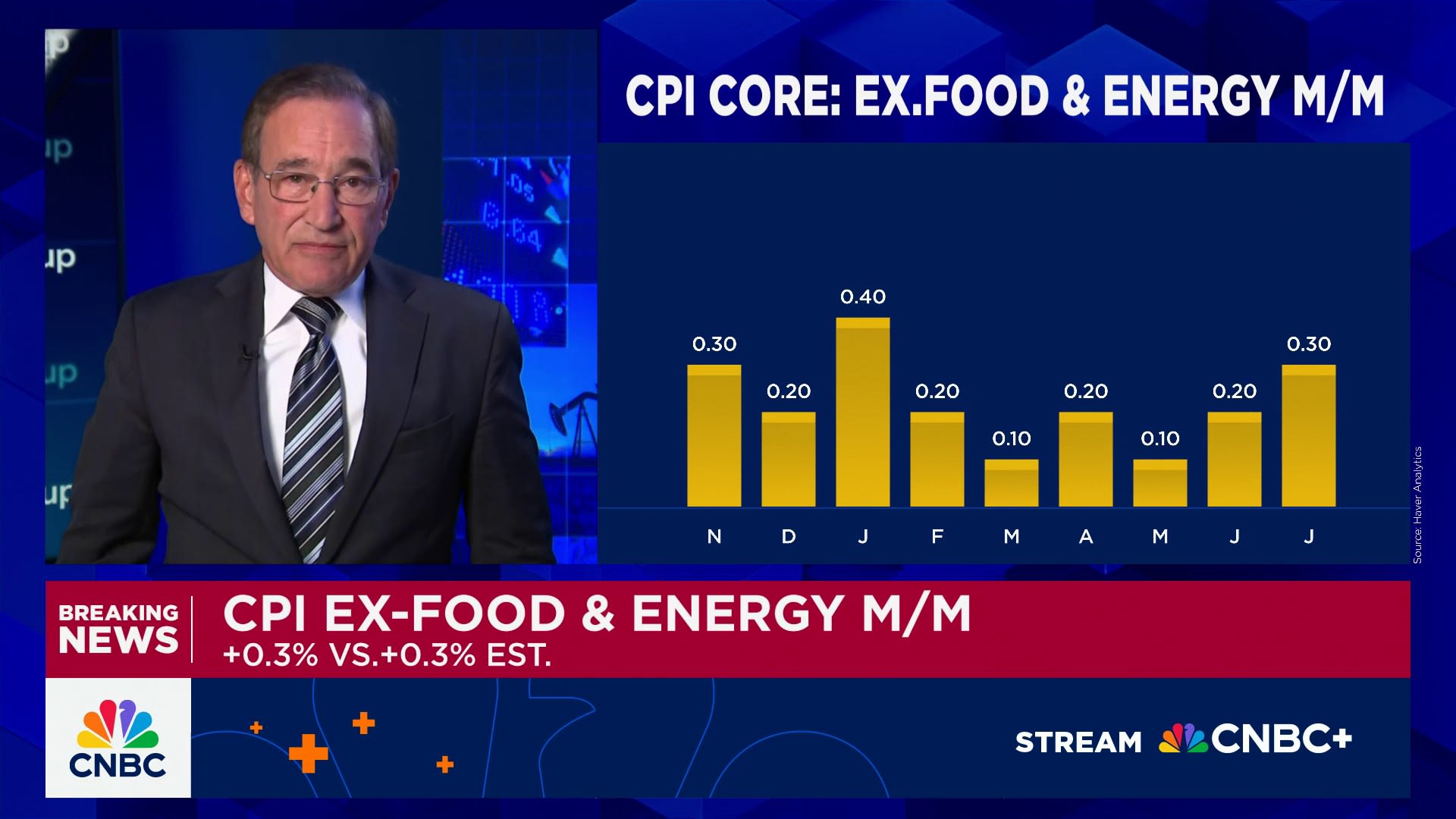

Excluding food and energy, the core CPI increased 0.3% for the month and 3.1% from a year ago, compared with the forecasts for 0.3% and 3%. Federal Reserve officials generally consider core inflation to be a better reading for longer-term trends. The monthly core rate was the biggest increase since January while the annual rate was the highest since February.

A 0.2% increase in shelter costs drove much of the rise in the index, while food prices were flat and energy fell 1.1%, the BLS said. Tariff-sensitive new vehicle prices also were unchanged though used cars and trucks saw a 0.5% jump. Transportation and medical care services both posted 0.8% moves higher.

Stock market averages posted strong gains after the report though Treasury yields were mixed. Traders ramped up bets that the Federal Reserve would start reducing rates again in September.

Tariffs did appear to show up in several categories.

For instance, household furnishings and supplies showed a 0.7% increase after rising 1% in June. However, apparel prices were up just 0.1% and core commodity prices increased just 0.2%. Canned fruits and vegetables, which generally are imported and also sensitive to tariffs, were flat.

“The tariffs are in the numbers, but they’re certainly not jumping out hair on fire at this point,” former White House economist Jared Bernstein said on CNBC. Bernstein served under former President Joe Biden.

The report comes at both a critical time for the economy and the BLS itself, which has come under Trump’s criticism for what he has charged is political bias against him. Trump fired the prior BLS commissioner after a surprisingly weak July nonfarm payrolls report earlier this month, and on Monday said he would nominate E.J. Antoni, a critic of the bureau, as the new chief.

The bureau has been hampered by budget and staffing cuts and has halted data collection in multiple cities. Along with that, the data has had to impute values in a number of the goods and services it tracks, leading to questions over accuracy and credibility.

While the political jockeying has occurred, Fed officials have been watching inflation measures closely as they weigh their next interest rate decision in September.

“Inflation is on the rise, but it didn’t increase as much as some people feared,” said Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management. “In the short term, markets will likely embrace these numbers because they should allow the Fed to focus on labor-market weakness and keep a September rate cut on the table. Longer term, we likely haven’t seen the end of rising prices as tariffs continue to work their way through the economy.”

At issue is whether the tariffs will cause a one-time price increase or will lead to a lasting upturn for inflation. Economists generally view tariff impacts as the former though the broad swath of items covered under Trump’s edicts have sparked worries that the effect could be longer lasting.

Futures market pricing is pointing strongly to a Fed rate cut in September. However, a raft of data between now and then could influence both the decision for that meeting and the central bank’s future course. Fed officials of late have been expressing increasing levels of concern about the labor market, which would bode for rate reductions.

Traders increased the implied odds for a September move following the release, and also put the chances of another reduction in October at about 67%, up from 55% the day before, according to the CME Group’s FedWatch tool.

The CPI is not the Fed’s primary inflation forecast tool. The central bank uses the Commerce Department’s personal consumption expenditures price index, but the CPI, as well as the producer price index that is scheduled to be released Thursday, feeds into that calculation.

Inflation-adjusted average hourly earnings rose just 0.1% for the month, the BLS said in a separate release. That put the annual gain at 1.2%.