Brazilian President Luiz Inacio Lula da Silva and China’s Great Wall Motor (GWM) CEO Mu Feng attend the opening of the GWM automobile factory on August 15, 2025, in Sao Paulo, Brazil.

China News Service | China News Service | Getty Images

BEIJING — Chinese electric car companies are increasing investments in overseas factories as they ramp up competition against Tesla and other global automakers.

For the first time since records going back to 2014, the Chinese electric car supply chain last year invested more outside the country than at home, according to a U.S.-based consulting firm Rhodium Group report published Monday.

The bulk of announced overseas investment, or 74%, was in battery factories, the report said. But it noted investment in assembly plants abroad was also “growing rapidly.”

The spending plans come as Chinese automakers face intense competition at home and higher tariffs on exports. Boosting investments abroad can help Chinese businesses win foreign governments’ support for market expansion.

“Growing regulatory pushback in host markets like the EU is raising barriers to entry and will push more Chinese companies to establish local manufacturing operations,” the Rhodium report said.

The Chinese electric car industry’s domestic investment in manufacturing tumbled sharply to $15 billion in 2024 from $41 billion in 2023 — after peaking at over $90 billion in 2022 in announced projects, according to Rhodium data.

While overseas investment has remained far lower, it “narrowly surpassed” domestic levels in 2024 for the first time, the report said, without sharing an exact figure.

More deals in the pipeline

Automotive was the second-most active sector for Chinese outbound investment in the second quarter this year, according to a separate Rhodium study released late July. The materials and metals sector ranked first.

“We recorded higher than usual activity by EV parts manufacturers, with eight transactions exceeding $100 million,” the July report said. “The largest among them was led by GEM, a Chinese battery materials manufacturer, which committed $293 million to expand its ternary precursors facility in Indonesia.”

Several overseas factory projects announced in recent years have also begun operations.

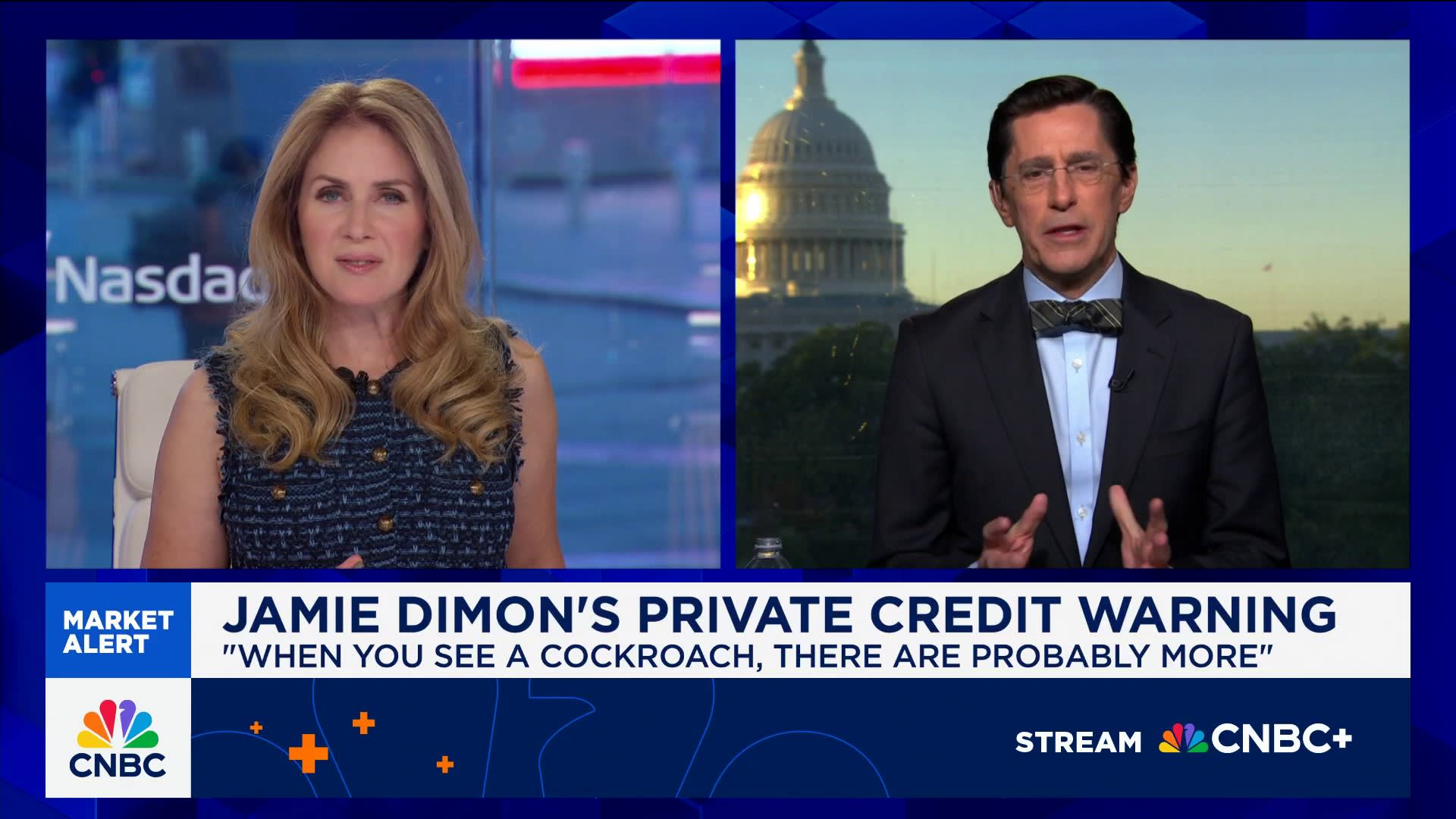

Great Wall Motor announced over the weekend it opened its first factory in Brazil on Friday local time. The company is also reportedly considering another factory in the region and would make the decision as soon as the middle of next year. The Chinese automaker did not immediately respond to a CNBC request for comment.

BYD also started production at its first Brazil factory in July, despite getting fined earlier in the year over labor practices. The Chinese electric car giant has sold more than 545,000 cars overseas this year as of July, exceeding the total of more than 417,000 vehicles for the whole of 2024, according to CNBC calculations of publicly disclosed data.

Earlier this summer, Chinese battery supplier Envision announced in June it officially started production at its first factory in France.

However, those investments abroad comprise completed projects only.

Just 25% of all announced overseas manufacturing plans by the Chinese electric car industry have been completed, far below the 45% rate for those at home, Rhodium said in Monday’s report, noting projects outside the country are twice as likely to get cancelled.

“Chinese firms will also have to manage Beijing’s increasing concern over technology leakage, job losses, and industrial hollowing-out, which may result in tighter controls on outbound investment in strategic sectors,” the report said.

—CNBC’s Victoria Yeo contributed to this report.