Prices consumers pay for a variety of goods and services moved higher than expected in August while jobless claims accelerated, providing challenging economic signals for the Federal Reserve before its meeting next week.

The consumer price index posted a seasonally adjusted 0.4% increase for the month, the biggest gain since January, putting the annual inflation rate at 2.9%, up 0.2 percentage point from the prior month and the highest reading since January. Economists surveyed by Dow Jones had been looking for respective readings of 0.3% and 2.9%.

For the vital core reading that excludes food and energy, the August gain was 0.3%, putting the 12-month figure at 3.1%, both as forecast. Fed officials consider core to be a better gauge of long-run trends. The central bank’s inflation target is 2%.

On employment, the Labor Department reported a surprise increase in weekly unemployment compensation filings to a seasonally adjusted 263,000 for the week ended Sept. 6, higher than the 235,000 estimate and up 27,000 from the prior period’s revised figure. The claims level marked the highest in nearly four years.

The reports provide the final pieces of a complicated data puzzle that central bankers will review at their two-day policy meeting that concludes Sept. 17.

Stocks rose sharply following the reports as traders priced in an even greater probability of interest rate reductions ahead.

“Today’s CPI report has been trumped by the jobless claims report,” wrote Seema Shah, chief global strategist at Principal Asset Management. “While the CPI report is a tad hotter than expected, it will not give the Fed a moment of hesitation when they announce a rate cut next week. If anything, the jump in jobless claims will inject a bit more urgency in the Fed’s decision making, with Powell likely signaling a sequence of rate cuts is on the way.”

The closely watched CPI reading saw its biggest gain from a 0.4% increase in shelter costs, which account for about one-third of the weighting in the index. Food prices jumped 0.5%, while energy was up 0.7% as gasoline rose 1.9%, likely indicating tariff impacts on prices.

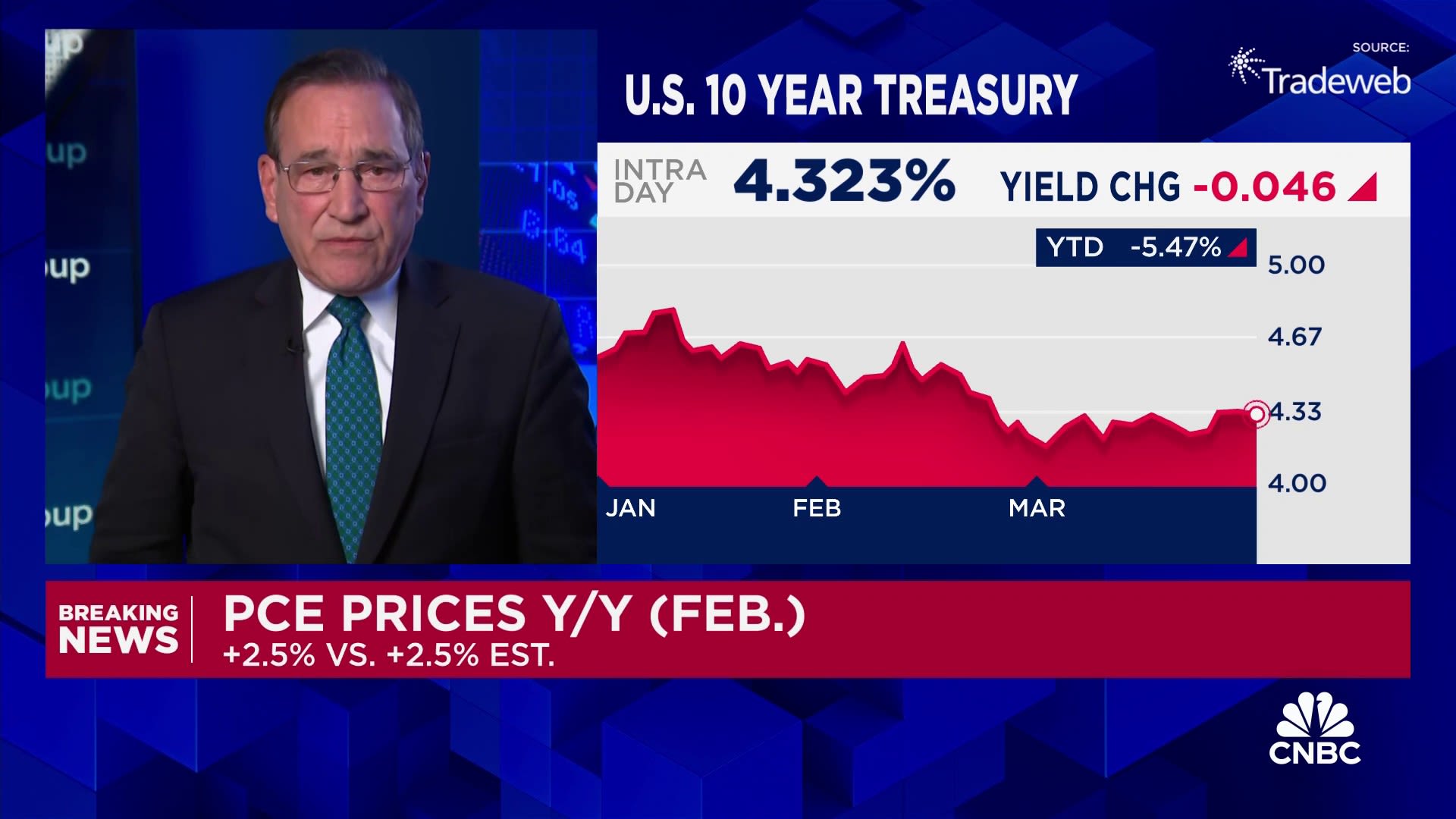

Market pricing indicates a 100% certainty that the Fed will lower its benchmark interest rate, currently targeted between 4.25%-4.5%. However, there has been a slight implied chance that the Fed might choose to deviate from its usual quarter percentage point move and cut by half a point considering weakness in the labor market this year and subdued inflation readings.

Traders also moved the probability of another reduction in October to a near certainty and see a high likelihood of a third move in December.

Fed officials have been watching the inflation data closely for clues on the impact from President Donald Trump‘s tariffs. There has been some visible pass-through from the duties, though inflation figures have been relatively well behaved. The BLS reported Wednesday that producer prices actually declined 0.1% in August.

Tariff-sensitive vehicle prices saw monthly increases, with new vehicles up 0.3%. Used cars and trucks, which are generally not influenced by tariffs, rose 1%.

The Fed, though, is more focused on services costs as signals of underlying inflation. Historically, tariffs have been looked at as temporary boosts to the prices of goods but not a longer-term inflation driver.

Services prices excluding energy rose 0.3% in August and are up 3.6% on the year. Shelter also was up 3.6% annually and has been steadily declining through the year after peaking above 8% in early 2023.

If Fed officials had any doubt about cutting, the jobless claims report may have sealed the deal.

Initial filings hit their highest point since Oct. 23, 2021, an indication that employers may now be cutting back on their workforce. Though hiring has slowed through the year, layoffs also have been tame, indicating more status quo rather than a material weakening in what Chair Jerome Powell repeatedly has termed a “solid” labor market.

Continuing claims, which run a week behind, held unchanged at 1.94 million but have been running near their highest level since late 2021 as well.