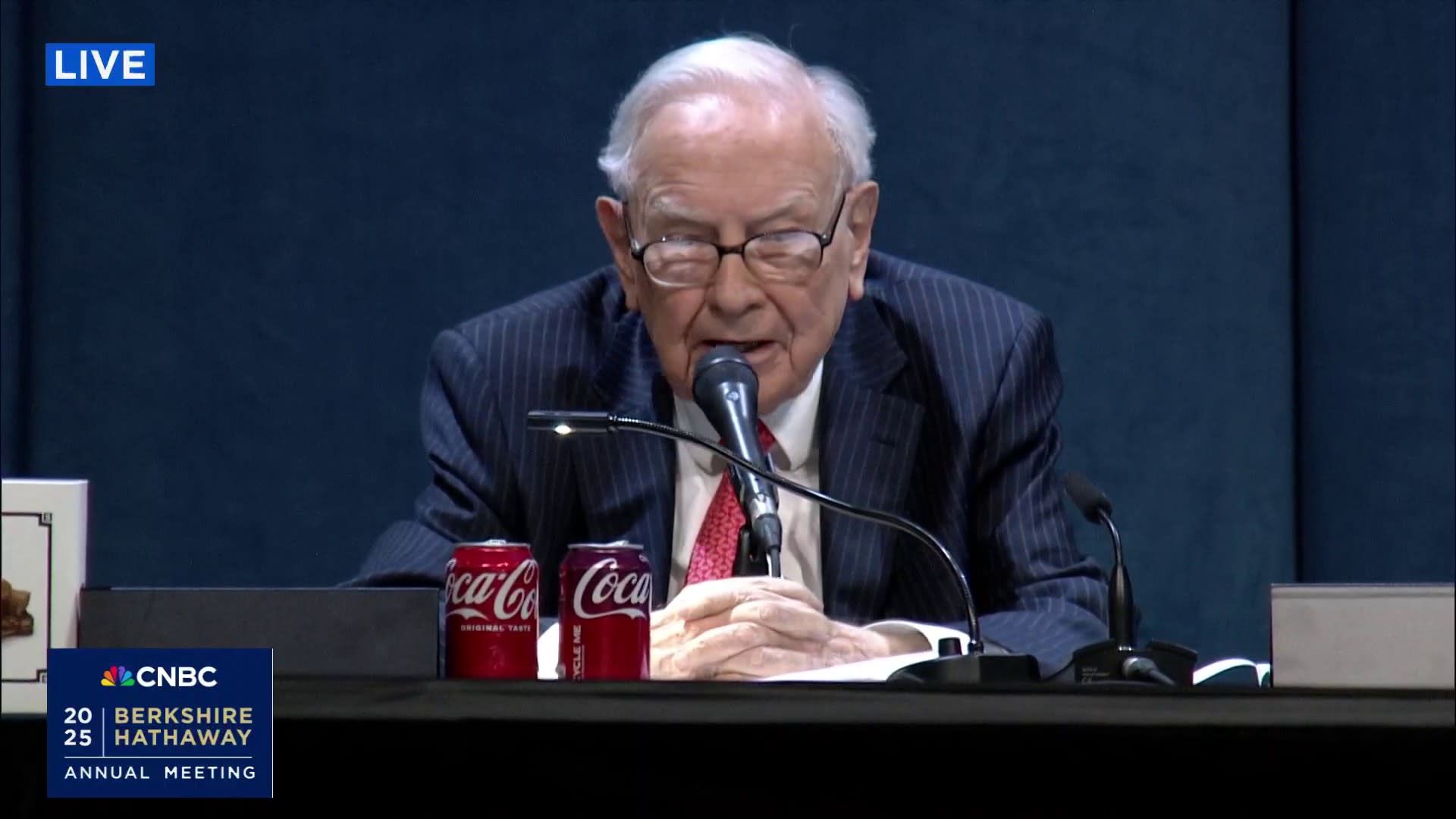

OMAHA, Nebraska — Warren Buffett on Saturday criticized President Donald Trump’s hardline trade policy, without naming him directly, saying it’s a big mistake to slap punitive tariffs on the rest of the world.

“Trade should not be a weapon,” Buffett said at Berkshire Hathaway‘s shareholder meeting, an annual gathering in front of thousands in Omaha, Nebraska. “I do think that the more prosperous the rest of the world becomes, it won’t be at our expense, the more prosperous we’ll become, and the safer we’ll feel, and your children will feel someday.”

Trade and tariffs “can be an act of war,” added the legendary investor. “And I think it’s led to bad things. Just the attitudes it’s brought out. In the United States, I mean, we should be looking to trade with the rest of the world and we should do what we do best and they should do what they do best.”

Buffett’s comments, his most direct yet on tariffs, came after the White House’s rollout of the highest levies on imports in generations shocked the world last month, triggering extreme volatility on Wall Street. The president later went on to announce a sudden 90-day pause on much of the increase, except for China, as the White House sought to make deals with countries. The pause has stabilized the market somewhat.

Still, Trump has slapped tariffs of 145% on imported Chinese goods this year, prompting China to impose retaliatory levies of 125%. China said last week it is evaluating the possibility of starting trade negotiations with the U.S.

Buffett explained that protectionist policies could have negative consequences over the long term for the U.S., after it’s become the leading industrial nation in the world.

“It’s a big mistake, in my view, when you have seven and a half billion people that don’t like you very well, and you got 300 million that are crowing in some way about how well they’ve done – I don’t think it’s right, and I don’t think it’s wise,” Buffett said. “The United States won. I mean, we have become an incredibly important country, starting from nothing 250 years ago. There’s not been anything like it.”

Investors had been waiting to hear from the 94-year-old “Oracle of Omaha” for his guidance to navigate the uncertain macroenvironment as well as his assessment on the state of the economy. The trillion-dollar Berkshire’s vast array of insurance, transportation, energy, retail and other businesses, from Geico to Burlington Northern to Dairy Queen, leave Buffett uniquely qualified to comment on the current health of the American economy. The first-quarter GDP was just reported to have contracted for the first time since 2022.

Berkshire said in its first-quarter earnings report that tariffs and other geopolitical events created “considerable uncertainty” for the conglomerate. The firm said it’s not able to predict any potential impact from tariffs at this time.

Buffett has been in a defensive mode, selling stocks for 10 straight quarters. Berkshire dumped more than $134 billion worth of stock in 2024, mainly due to reductions in Berkshire’s two largest equity holdings — Apple and Bank of America. As a result of the selling spree, Berkshire’s enormous pile of cash grew to yet another record, at $347 billion at the end of March.