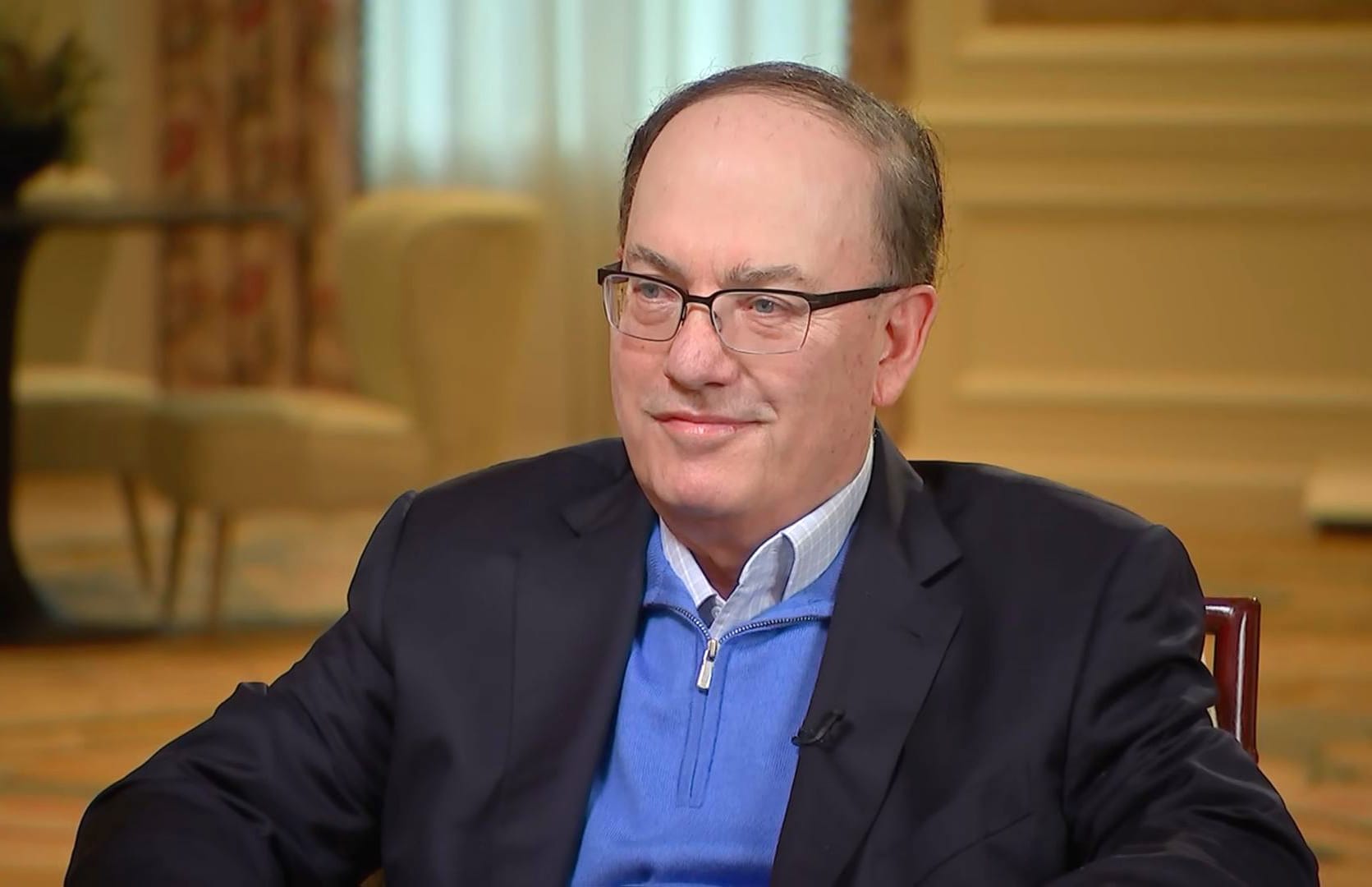

Russell Vought, director of the Office of Management and Budget (OMB) nominee for US President Donald Trump, during a Senate Budget Committee confirmation hearing in Washington, DC, US, on Wednesday, Jan. 22, 2025.

Al Drago | Bloomberg | Getty Images

The Consumer Financial Protection Bureau‘s new leadership on Thursday dismissed at least four enforcement lawsuits undertaken by the previous administration’s director.

In legal filings, the CFPB issued a notice of voluntary dismissal for cases involving Capital One; Berkshire Hathaway-owned Vanderbilt Mortgage & Finance; a Rocket Cos. unit called Rocket Homes Real Estate; and a loan servicer named Pennsylvania Higher Education Assistance Agency.

“The Plaintiff, the Consumer Financial Protection Bureau, dismisses with prejudice this action against all Defendants,” the agency said in the Capital One case. It used similar language in the other cases.

The moves are the latest sign of the abrupt shift at the agency since acting CFPB Director Russell Vought took over this month. In conjunction with Elon Musk‘s Department of Government Efficiency, the CFPB has shuttered its Washington headquarters, fired about 200 employees and told those who remain to stop nearly all work.

Under former Director Rohit Chopra, the CFPB accused Capital One of bilking customers out of more than $2 billion in interest; it said Vanderbilt ignored signs that customers couldn’t afford its mortgages; it accused Rocket of providing illegal kickbacks to real estate agents; and it said that loan servicer Pennsylvania Higher Education Assistance Agency improperly collected loans.

A Capital One spokesman said the bank welcomed the dismissal of its case, which it “strongly disputed.”

A spokesman for Rocket also lauded the news: “Rocket Homes has always connected buyers with top-performing agents based only on objective criteria like how well they helped homebuyers achieve their dream of homeownership. We are proud to put this matter behind us.”

Shares of Capital One and Rocket climbed after the dismissals.

Billions lost

Current and former CFPB employees have told CNBC that legal cases with upcoming docket dates would likely be dismissed as the agency disavows most of what Chopra has done.

That began late last week, when the agency dismissed its case against SoLo Funds, a fintech lender it had earlier accused of gouging customers.

Eric Halperin, the CFPB’s former head of enforcement, said in a phone interview Thursday that the spate of CFPB dismissals was unprecedented in the bureau’s history.

“Five cases have been dismissed so far by this administration, whereas in the entire history of the bureau, there’s only been one other case dismissed without relief for any consumers,” Halperin said.

On Friday, the CFPB also dropped its case against TransUnion that accused the credit agency of violating a 2017 order related to the company’s marketing of its credit tools to consumers.

“We are pleased with the dismissal of this case, which reflects our long-standing view of the facts and our ongoing work to support consumers,” a TransUnion spokesperson wrote in a statement to CNBC.

Since the recent cases were dismissed with prejudice, the CFPB has agreed to never bring these claims again, shutting off the possibility of clawing back funds for consumer relief, Halperin added.

“Just from the cases that were dismissed today, there’s billions of dollars in consumer harm that the CFPB will never be able to get back for consumers,” he said.

‘Embarrass you’

The Thursday filings began appearing at the same time that senators were grilling Jonathan McKernan, President Donald Trump‘s pick to lead the CFPB on a permanent basis, during a nomination hearing.

“Mr. McKernan, literally while you’ve been sitting here and you’ve been talking about the importance of following the law, we get the news that the CFPB is dropping lawsuits against companies that are cheating American families, or alleged to be cheating American families,” Sen. Elizabeth Warren, D-Mass., said.

“It seems to me the timing of that announcement is designed to embarrass you,” Warren said.